About Provider

Rick Knox

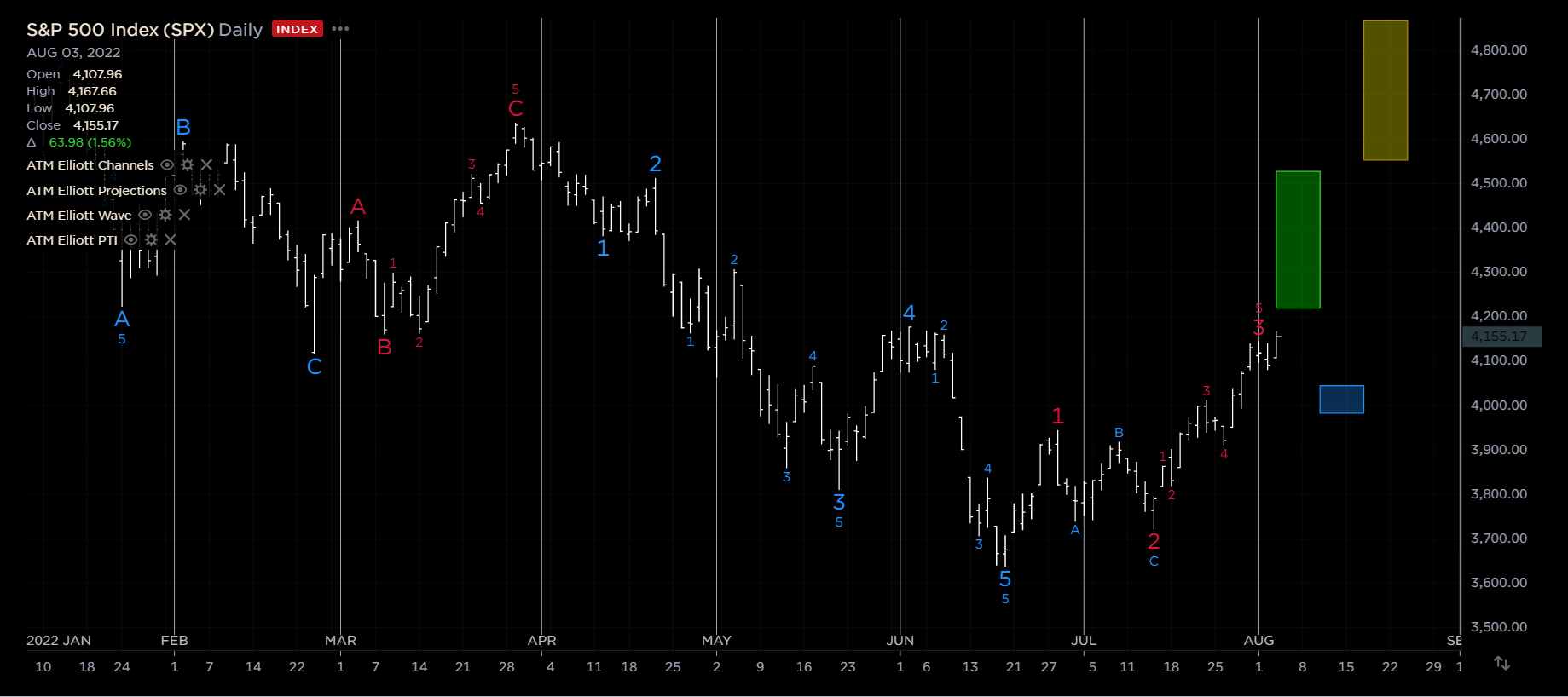

Rick Knox is the founder and sole owner of Capital Markets Research and Advanced Trading Methods. He is the creator of ATM Studies – a set of proprietary mathematical models – used globally by Bloomberg, CQG, and Symbolik professional traders and industries for market timing and momentum interpretation.

Rick began his career as a member of the Chicago Board of Trade and the Chicago Mercantile Exchange. During his time as a floor trader, Rick developed a passion for learning the movements of the markets and how to unlock the mysteries of market timing. He served as the EVP of CQG, responsible for thought leadership, international market expansion, and third-party services. This position allowed him to work and train with some of the leading market gurus. Under Rick’s guidance, CQG became the first quote vendor to introduce the DeMark Indicators, Candlestick charting, Market Profile, and Elliott Wave Analysis (later purchased by ATM and included in the ATM Symbolik application).

Thanks to Tom DeMark, Rick connected with Bloomberg and Bloomberg’s broker-dealer – Tradebook, becoming the one of the first software vendor accepted into Bloomberg’s APPS portal. As a result, Capital Markets Research became a preferred research provider and lecturer for Bloomberg’s global client base in New York, London, Switzerland, Frankfurt, Hong Kong, and Singapore.

His company’s clients include international hedge funds, broker-dealers, and private family offices.